IIFL, which stands for India Infoline Limited, primarily operates as a financial services company in India. It offers a range of financial products and services but does not operate as a full-fledged bank, and in this blog, you are going to learn everything you should know about IIFL in 2023.

Everything you need to know about IIFL in 2023

- 15, May 2023

- Loan

IIFL full form?

IIFL stands for "India Infoline Limited."

What is IIFL bank's full form?

IIFL, which stands for India Infoline Limited, primarily operates as a financial services company in India. It offers a range of financial products and services but does not operate as a full-fledged bank. It provides services such as retail and institutional broking, wealth and asset management, investment banking, and lending solutions.

What is IIFL wealth share price?

IIFL wealth share price has been fluctuating up and down since start of this year but this is not surprising because we know that this is how the market works for now IIFL wealth share price is given below:

IIFL wealth share price - ₹410.00 (↑ ₹0.95 • 0.23%)

Prev Close - ₹409.05

Day's Open - ₹414.75

Today's High - ₹416.95

Today's Low - ₹406.75

Today's Volume - 3,08,497

What is Crm IIFL in?

In the context of IIFL, CRM IIFL refers to the CRM system implemented by IIFL to manage their customer relationships. This CRM system would help IIFL track customer interactions, manage leads and prospects, analyze customer data, and improve customer satisfaction and retention. It plays a crucial role in streamlining and optimizing the company's customer-centric operations and helps in providing personalized services to clients.

IIFL Cibil Score

CIBIL score, also known as the Credit Score, is a numeric representation of an individual's creditworthiness. It is based on their credit history and repayment behavior, reflecting how likely they are to repay their debts on time. CIBIL (Credit Information Bureau India Limited) is one of the credit information companies in India that calculates credit scores.

CIBIL scores range from 300 to 900, with a higher score indicating a stronger credit profile and a lower credit risk. Lenders, such as banks and financial institutions, use CIBIL scores as one of the factors to evaluate loan and credit card applications. A good credit score enhances the chances of loan approval and may also lead to better terms, such as lower interest rates.

Several factors influence the CIBIL score, including the individual's credit repayment history, credit utilization, length of credit history, types of credit used, and any recent credit inquiries. Timely repayment of loans and credit card bills, maintaining a low credit utilization ratio, and having a mix of credit types can help improve the credit score.

It's advisable to regularly monitor your CIBIL score and review your credit report for accuracy. If there are any discrepancies or errors, you can rectify them by contacting CIBIL or the respective credit information company and providing the necessary documentation for correction.

IIFL Mortgage Loan

IIFL (India Infoline Limited) Mortgage Loan is a type of loan offered by IIFL, a leading financial services company in India. It is designed to help individuals and businesses meet their financial requirements by providing funds against the mortgage or collateral of a property.

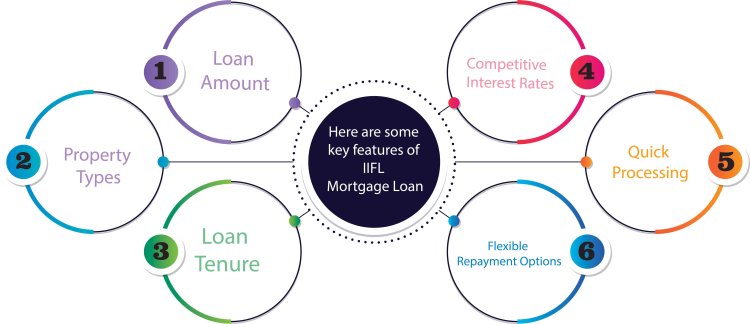

Here are some key features of IIFL Mortgage Loan:

Loan Amount: IIFL offers mortgage loans with flexible loan amounts based on the value of the property being mortgaged and the borrower's eligibility criteria.

Property Types: IIFL Mortgage Loan is available for various types of properties, including residential, commercial, and industrial properties.

Loan Tenure: The loan tenure can vary depending on the borrower's requirements and eligibility, ranging from a few months to several years.

Competitive Interest Rates: IIFL aims to provide competitive interest rates on its mortgage loans, which are determined based on the borrower's creditworthiness, loan amount, and prevailing market conditions.

Quick Processing: IIFL strives to provide a smooth and efficient loan processing experience, with minimal paperwork and quick disbursal of funds.

Flexible Repayment Options: IIFL offers flexible repayment options, allowing borrowers to choose from various repayment methods such as equated monthly installments (EMIs), structured repayment plans, or customized payment schedules.

It's important to note that specific terms and conditions, eligibility criteria, and interest rates may vary for IIFL Mortgage Loans. It is advisable to contact IIFL directly or visit their official website for detailed information, personalized loan offers, and to understand the complete terms and requirements associated with their mortgage loan products.

IIFL home loan interest rate

Home loan interest rate is: 16.25% till 1st December 2022

Non home loan interest rate is: 18.55% till 1st December 2022

IIFL samasta finance limited

IIFL Samasta Finance Limited is a subsidiary of India Infoline Limited (IIFL). It is a non-banking financial company (NBFC) that primarily focuses on providing microfinance services to individuals and small businesses in India. The company specializes in offering small-ticket loans to borrowers who may not have access to traditional banking services.

IIFL Samasta Finance Limited aims to empower the economically underserved segments of society by providing them with financial assistance for various purposes, such as business expansion, education, healthcare, and housing improvements. The loans offered by IIFL Samasta Finance are typically tailored to meet the specific needs of low-income individuals and micro-entrepreneurs.

The company follows responsible lending practices, conducts thorough credit assessments, and offers personalized financial solutions to its customers. It strives to create a positive social impact by promoting financial inclusion and facilitating economic growth at the grassroots level.

It's important to note that the specific products, services, and operations of IIFL Samasta Finance Limited may be subject to change. For the most accurate and up-to-date information, it's recommended to visit the official website of IIFL or contact them directly.

Conclusion

One of the key strengths of IIFL is its extensive network of branches and sub-brokers across India, which allows it to reach a wide customer base. The company has also made efforts to leverage technology in its operations, providing online trading platforms and mobile applications for convenience and accessibility.

However, like any financial services company, IIFL is subject to various market risks, regulatory changes, and economic fluctuations. It is important for investors and customers to stay updated on the company's financial performance, management strategies, and industry trends to make informed decisions.