In this blog, you will be able to know how you are supposed to know how to use sip calculator Excel which will help you out in figuring out how you should use it for your own benefit.

How to use SIP calculator excel?

- 17, Aug 2023

- Investment

Nowadays most traders or investors prefer to invest their funds at a regular interval with the systematic investment plan (SIP). And it's a very smart move to average out your investment during different phases of the market. SIP always provides you with good returns which is specifically for long-term SIP. Now it's totally up to you if you want to do mutual fund calculator Excel as well as stocks, even though it's more popular among mutual fund investors. In this post, Now let's begin the tutorial to calculate SIP returns in an Excel sheet.

Calculate SIP Returns through Excel FV Function

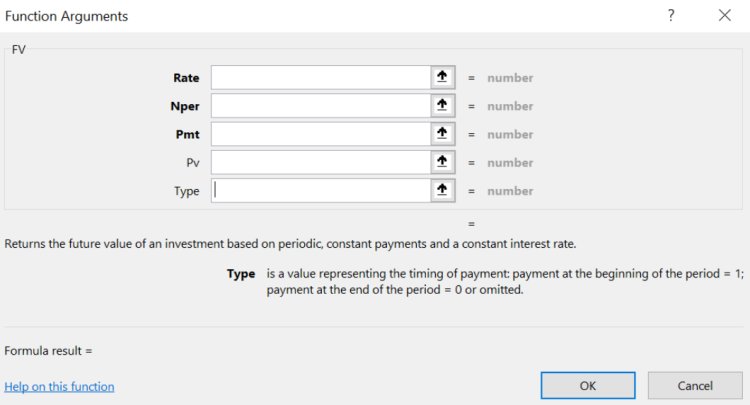

To easily calculate return on your investment Microsoft Excel is used to have a ready-made FV which is also known as FV (Final Value) function.

The final value function usually accepts 5 arguments, out of which 3 are used to be mandatory.

- Rate: For the specific period it's the rate of the return.

For example, by any chance, if you are expecting a 15% per annum return for your mutual fund SIP, then the rate would be 15/12=1.25% per month.

- Nper: Investment made for some specific period. So, by any chance, if you are investing a certain amount for 5 years every month, then your Nper most likely will be 5*12 = 60

- Pmt: Investment for a particular period, can also be known or called SIP amount. It represents the net outflow of money which is usually expressed in negative.

- Pv: Before starting to use SIP started initial invested amount is known as Pv. The default is 0.

- Type: When the investment is used to be made for a particular period. 1 denotes the beginning of the period and on the other hand, 0 denotes the end of the period.

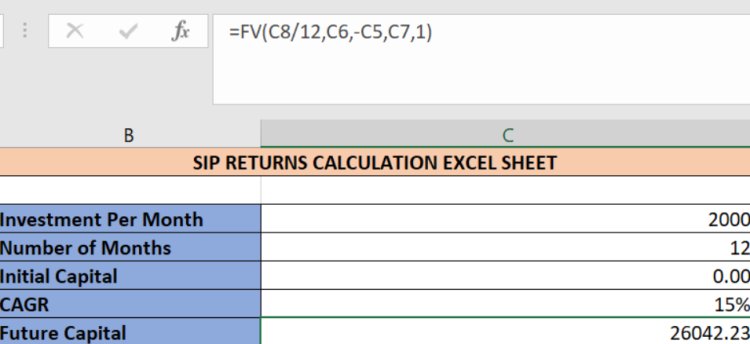

If you want to know specifically how this function is used in the Excel sheet to calculate the final capital for an SIP investment with 15% per annum return then see below.

It's interesting to know that this is very useful and abstracts a lot of complexity mostly from the users.

Calculate SIP Returns manually

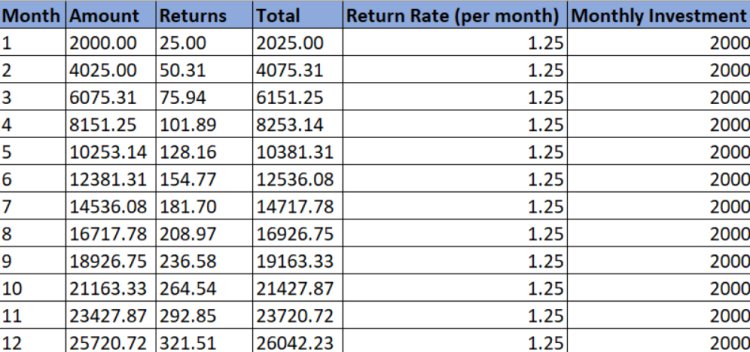

Not being able to see how your investment is growing month on month is the only drawback of using the Final Value (FV). Hence, we bring a method with the help of which you can calculate your SIP returns without using this function.

With the help of this method, you will be able to see the month-wise returns on your investment.

See the below screenshot:

You might notice that the final capital is usually same for the both calculation methods which is 26042.23

If you want to derive the rate per month then you are supposed to divide the expected CAGR with 12 and on the other hand returns column shows how much ROI is expected for that particular month.

It's fortunate for you to know that you can easily modify the values for 'Monthly Investment' and 'Return Rate to simply calculate the final capital for different scenarios.

Conclusion

The information provided in this blog is for educational purposes only and should not be considered financial or investment advice. Trading in stocks and securities involves risks, and individuals should carefully evaluate their financial situation and consult with professionals before making any trading decisions, you can take the help of Finskool advisory service which will increase your chances of earning profit.